Safeguarding Your Rental: A Comprehensive Guide to Renters Insurance!

Advertisement

Renting a home or apartment offers flexibility and convenience, but it's essential to protect your personal belongings and financial well-being. That's where renters insurance comes into play. In this article, we'll explore what renters insurance is, what it covers, what it doesn't cover, the associated costs, and the availability of renters insurance across different states.

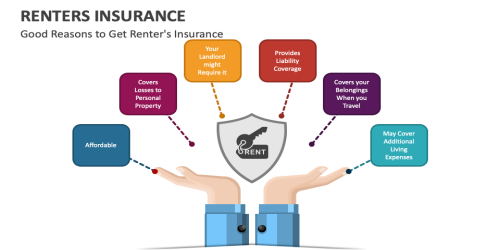

Renters insurance is a type of insurance policy designed to protect tenants from financial losses due to unforeseen events. It provides coverage for personal belongings, liability protection, and additional living expenses in case you're unable to stay in your rented property due to covered perils.

Renters insurance typically covers three primary areas:

a) Personal property coverage: This protects your belongings, such as furniture, electronics, and clothing, against losses caused by covered perils like fire, theft, vandalism, or water damage.

b) Liability protection: If someone is injured while visiting your rental property, renters insurance can help cover their medical expenses and legal fees if you're found responsible.

c) Additional living expenses: If your rental becomes uninhabitable due to a covered event, renters insurance can assist with temporary living arrangements, such as hotel stays or rental costs.

While renters insurance provides valuable coverage, it typically excludes certain situations, such as:

a) Natural disasters: Standard policies may not cover damage caused by earthquakes, floods, or hurricanes. However, some insurers offer separate coverage for these events.

b) Intentional damage: If you intentionally cause damage to your rental property or personal belongings, it won't be covered.

c) Certain high-value items: Items like jewelry, collectibles, or expensive artwork may have limited coverage, so additional insurance or policy endorsements may be necessary to adequately protect them.

The cost of renters insurance varies based on factors such as location, coverage limits, deductible amount, and the tenant's claims history. On average, renters insurance can range from $15 to $30 per month. The cost is relatively affordable compared to other types of insurance, making it an excellent investment to safeguard your possessions and personal liability.

Renters insurance is widely available across the United States. While it is offered in all states, specific policy terms, coverage limits, and pricing may vary. It's important to research and compare different insurance providers to find the best coverage and rates that suit your needs and location.

Renters insurance is an essential investment for tenants, offering protection for personal belongings, liability coverage, and additional living expenses. While it provides comprehensive coverage for many unforeseen events, certain situations and items may not be covered. By understanding what renters insurance includes, excludes, and costs, you can make informed decisions to protect yourself and your possessions in your rented home or apartment.

Advertisement

Advertisement

- Previous article

- Crucial Factors for Your Ideal New Construction Home: A Guide to Finding Your Dream Residence!

- Next article

- Exploring the World of Real Estate: A Comprehensive Guide!

Advertisement

OTHER NEWS

When a Couple Buys a House Together, who is Better to Choose as the Primary Lender for the Loan?

BY Little Grapes

A Financial Outlook on the Auto Parts Industry

BY Little Grapes

The Best Time to Apply for a Credit Card.

BY Wendy

The Pros and Cons of Personal Loans and how to get one

BY Little Grapes

The Apple Phenomenon: Unraveling the Success Behind High Mobile Phone Sales

BY Little Grapes

What do you Know About Credit Scores!

BY Little Grapes

RECENT NEWS

-

Demystifying Bitcoin

-

Securing and Maintaining High Limit Credit Cards: A Comprehensive Guide!

-

The investment value of men’s watches

-

Guarding Against Credit Card Fraud: What to Do If Your Identity Is Compromised?

-

Strategies for Success in the Watch Industry

-

Understanding Survivorship Life Insurance: Planning for the Future Together!

0

0 0

0