Comparing Cash-Out Refinancing Rates: Making Informed Financial Decisions

Advertisement

In the realm of personal finance, making wise decisions about mortgage options is of paramount importance. One such option that homeowners often consider is cash-out refinancing, a strategy that allows homeowners to access the equity built up in their homes. By refinancing their mortgage at a higher balance than their current loan, homeowners can receive a lump sum of cash, which can be used for a variety of purposes, such as home improvements, debt consolidation, or major life expenses. However, before embarking on this financial journey, it's crucial to understand and compare cash-out refinancing rates to make an informed decision.

Understanding Cash-Out Refinancing

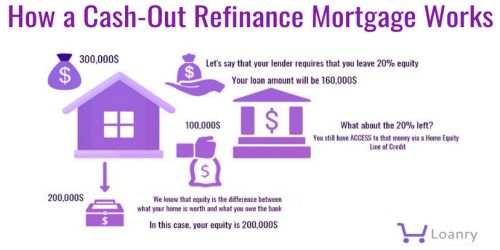

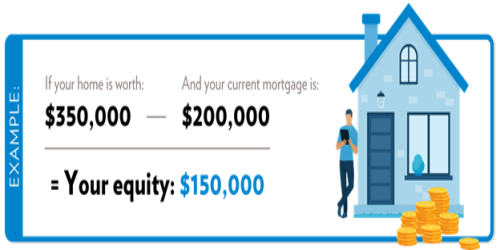

Cash-out refinancing involves replacing an existing mortgage with a new one that has a higher balance. The difference between the new mortgage balance and the old one is given to the homeowner in cash. This strategy enables homeowners to tap into the equity they've accrued in their property, which is the difference between the home's current market value and the remaining mortgage balance. Unlike a home equity loan or line of credit, cash-out refinancing results in a single, new mortgage with a potentially different interest rate and loan terms.

Comparing Interest Rates

One of the most critical aspects of any mortgage, including cash-out refinancing, is the interest rate. The interest rate determines the cost of borrowing and significantly impacts the overall financial implications of the refinancing decision. When comparing cash-out refinancing rates, homeowners should consider both the nominal interest rate and the annual percentage rate (APR).

The nominal interest rate is the base interest rate applied to the loan principal. However, the APR provides a more comprehensive view of the overall cost of borrowing. The APR includes not only the nominal interest rate but also any additional fees and charges associated with the loan. This could include origination fees, points, and closing costs. By comparing the APR, homeowners can get a clearer picture of the total cost of the cash-out refinancing option.

Factors Influencing Rates

Several factors influence the rates offered for cash-out refinancing. One of the most significant factors is the homeowner's credit score. Lenders use credit scores to assess the borrower's creditworthiness. Borrowers with higher credit scores are often offered lower interest rates because they are considered less risky to lenders. It's essential for homeowners to know their credit scores and take steps to improve them if necessary before considering cash-out refinancing.

Another factor is the current market interest rates. Mortgage rates can fluctuate based on broader economic conditions and trends in the housing market. Before proceeding with cash-out refinancing, homeowners should research the current interest rate environment and consider waiting for a favorable market if rates are particularly high at the time.

Comparing Lender Offers

When comparing cash-out refinancing rates, homeowners should seek offers from multiple lenders. Different lenders might offer varying rates and terms based on their underwriting criteria and business strategies. Online mortgage comparison tools and platforms can be invaluable in streamlining the process of gathering quotes from multiple lenders.

However, it's important not to solely focus on the interest rate. Homeowners should also consider the reputation and credibility of the lender, their customer service, and any potential hidden fees. Reading reviews, asking for recommendations, and directly communicating with lenders can provide insights into the overall experience of working with each lender.

Considering Loan Terms

In addition to interest rates, homeowners must also consider the loan terms when comparing cash-out refinancing options. Loan terms encompass the length of the loan (often 15 or 30 years) and the type of interest rate (fixed or adjustable). Fixed-rate mortgages offer stability with consistent monthly payments, while adjustable-rate mortgages may have lower initial rates but can increase over time, potentially leading to higher payments.

When comparing loan terms, homeowners should assess their financial goals and capabilities. A shorter loan term may lead to higher monthly payments but could result in less overall interest paid over the life of the loan. Conversely, a longer loan term might lead to more interest paid but offer more manageable monthly payments.

In the world of personal finance, cash-out refinancing can be a valuable tool for leveraging the equity in a home. However, making an informed decision requires a comprehensive understanding of cash-out refinancing rates, terms, and the factors that influence them. Homeowners must carefully compare offers from different lenders, considering both interest rates and APR, while also taking into account their credit score, the current interest rate environment, and their financial goals. By conducting thorough research and seeking professional advice if needed, homeowners can make a confident choice that aligns with their long-term financial objectives.

Advertisement

Advertisement

- Previous article

- Understanding Credit Life Insurance: Protection for Borrowers!

- Next article

- Understanding Universal Life Insurance: A Comprehensive Overview!

Advertisement

OTHER NEWS

How do I use my Credit Card Wisely?

BY Anna

Unraveling the Tax Mysteries of Credit Card Rewards!

BY Wendy

How Should I Pick my Insurance?

BY Little Grapes

Salvaging Credit Cards with Low Credit Scores: Tips and Strategies for Financial Recovery!

BY Wendy

The Thrills of PUBG MOBILE

BY Little Grapes

Why Should all Young People Have a Credit Card of Their own?

BY Little Grapes

RECENT NEWS

-

Demystifying Bitcoin

-

Securing and Maintaining High Limit Credit Cards: A Comprehensive Guide!

-

The investment value of men’s watches

-

Guarding Against Credit Card Fraud: What to Do If Your Identity Is Compromised?

-

Strategies for Success in the Watch Industry

-

Understanding Survivorship Life Insurance: Planning for the Future Together!

1

1 1

1