Advertisement

Banking is an integral part of our daily lives, serving as the cornerstone of our modern financial system. It is a complex web of institutions, services, and regulations that facilitate economic transactions, savings, and investments. In this informative piece, we will delve into the workings of the banking system, shedding light on its fundamental principles, types of banks, core functions, and the role of technology in shaping the future of banking.

I. The Foundations of Banking

1.1 Historical Evolution

The roots of modern banking can be traced back to ancient civilizations, where early forms of banking involved the safekeeping of valuable assets and the issuance of promissory notes. Over time, these practices evolved, and banking institutions emerged to provide a more organized and efficient means of managing wealth and facilitating trade. Today, banking is a multifaceted industry that plays a critical role in the global economy.

1.2 The Banking System

The banking system can be broadly categorized into two main types of banks: commercial banks and central banks.

A. Commercial Banks

Commercial banks are the cornerstone of the banking system. They are financial institutions that serve individuals, businesses, and governments. Commercial banks provide a wide range of services, including savings and checking accounts, loans, credit cards, and investment products. They play a crucial role in channeling funds from savers to borrowers, thereby supporting economic growth and development.

B. Central Banks

Central banks are responsible for overseeing and regulating the entire banking system within a country. They play a pivotal role in controlling the money supply, stabilizing prices, and ensuring the stability of the financial system. Central banks are often independent entities with a primary mandate to maintain monetary stability and support economic growth.

II. Core Functions of Banking

2.1 Depository Functions

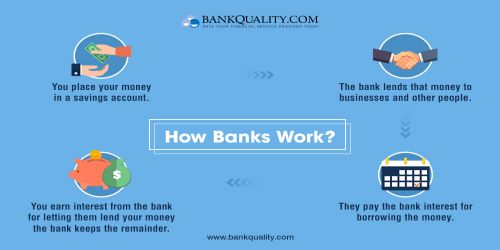

One of the primary functions of banks is to provide a safe place for individuals and businesses to deposit their funds. Banks offer various types of deposit accounts, including savings accounts, checking accounts, and certificates of deposit (CDs). Deposits are insured up to a certain limit by government-backed agencies, such as the Federal Deposit Insurance Corporation (FDIC) in the United States.

2.2 Lending Functions

Banks serve as intermediaries between savers and borrowers. They take in deposits from individuals and businesses and use those funds to provide loans and credit to borrowers. This lending activity includes personal loans, mortgages, business loans, and more. The interest earned on loans is a primary source of revenue for banks.

2.3 Payment Functions

Banks facilitate the transfer of funds between individuals and entities through various payment mechanisms. This includes processing checks, electronic fund transfers, wire transfers, and issuing credit and debit cards. The payment functions of banks are essential for the efficient functioning of modern economies.

III. The Role of Technology in Banking

3.1 Digital Banking

Advancements in technology have transformed the banking landscape, giving rise to digital banking. Customers can now access their accounts, make transactions, and manage their finances online or through mobile apps. This convenience has revolutionized the way we interact with banks, making banking services accessible 24/7 from anywhere in the world.

3.2 Fintech and Innovation

The emergence of fintech (financial technology) startups has disrupted traditional banking models. Fintech companies leverage technology to provide innovative financial services, including peer-to-peer lending, robo-advisors, and blockchain-based cryptocurrencies like Bitcoin. These innovations are challenging the status quo and driving competition in the financial sector.

3.3 Online Security

As banking transactions increasingly occur in the digital realm, cybersecurity has become a paramount concern. Banks invest heavily in cybersecurity measures to protect customer data and financial assets. Encryption, multi-factor authentication, and continuous monitoring are some of the tools used to safeguard online banking.

IV. Regulations and Oversight

4.1 Banking Regulations

The banking industry is subject to a complex web of regulations designed to ensure stability, protect consumers, and maintain the integrity of financial markets. Regulatory bodies, such as the Federal Reserve in the United States, set monetary policy and enforce regulations that govern banks' capital requirements, lending practices, and risk management.

4.2 Financial Stability

The 2008 global financial crisis underscored the importance of effective regulation and oversight in banking. Governments and central banks work to maintain financial stability through measures like stress tests, capital adequacy requirements, and the supervision of systemic risk.

V. The Future of Banking

5.1 Artificial Intelligence and Automation

The future of banking holds exciting prospects for artificial intelligence (AI) and automation. AI-driven chatbots and virtual assistants are becoming commonplace in customer service, and machine learning algorithms are improving credit risk assessment and fraud detection. Automation is streamlining processes, reducing costs, and enhancing efficiency.

5.2 Open Banking

Open banking initiatives are opening up opportunities for increased competition and innovation. These initiatives require banks to share customer data securely with authorized third-party providers, enabling consumers to access a broader range of financial services and compare offerings more easily.

Banking, as we know it, has come a long way from its historical roots. It has evolved into a sophisticated system of financial institutions that perform vital functions in our globalized economy. With the advent of technology, banking has become more accessible and efficient, offering a wide array of services tailored to individual needs. As we move forward, the banking industry will continue to adapt to the changing landscape, embracing innovation while adhering to essential regulatory safeguards, ensuring its continued role as a cornerstone of modern finance.

Advertisement

Advertisement

- Previous article

- Understanding Short-Term Life Insurance: A Quick Guide!

- Next article

- You need to know this to play Candy Crush Soda Saga!

Advertisement

OTHER NEWS

Demystifying Bitcoin

BY Little Grapes

Unleashing the Power of Cash Back Cards: Exploring the Best Options

BY Little Grapes

It is Best to Consider These Factors When Buying a Home.

BY Wendy

Unmasking Real Estate Fraud: Types and Solutions!

BY Wendy

How to Choose a Credit Card That Suits you?

BY LI

How can you Improve Your Credit Score in the USA?

BY Anna

RECENT NEWS

-

Demystifying Bitcoin

-

Securing and Maintaining High Limit Credit Cards: A Comprehensive Guide!

-

The investment value of men’s watches

-

Guarding Against Credit Card Fraud: What to Do If Your Identity Is Compromised?

-

Strategies for Success in the Watch Industry

-

Understanding Survivorship Life Insurance: Planning for the Future Together!

1

1 0

0