Saudi Arabia’s SAMA Opening-Up Policy Is Conductive to E-Commerce Development in the Middle East in 2021

Advertisement

How does Open Banking work?

Abdulla Almoayed, CEO of Tarabut Gateway told Gulf News that Open Banking does not give everybody access to data. “Unless a customer expressly gives consent, data cannot be shared at all. Only the user can access their own personal information,” Almoayed said.

Almoayed explained that user permissions are granted (or revoked) through either a Face ID or biometric data, which is many times more secure than current banking authentication procedures such as passcodes or asking for your mother’s maiden name. Algorithms within the open banking API infrastructure anonymize information and aggregate it so that new technology providers can develop new products and services that are supported by robust data.

“These processes ensure that the right products are offered to the user, but without third-parties specifically being able to trace that information back to the individual,” Almoayed said. “Simply put, Open Banking puts the power of personal data back in the hands of the consumer. It will take time for customers to understand and trust that Open Banking is less about one person’s information. Rather, it’s connecting banks and fintechs with a collective pool of data that can empower businesses to innovate more intelligent products and services that are suited to the needs of the customer.”

What is the impact on e-commerce and online payments?

Helping Open Banking thrive in the region are two factors. The first is e-wallets. “The launch and proliferation of e-wallets have been building this year, but this trend will really take precedence in the world of payments in 2021. The global mobile wallets industry is predicted to jump by almost 50%, to reach a value of $1.47trn amid the Covid-19 pandemic, with more than 1.7bn people using mobile wallets by 2024.

Advertisement

The e-commerce and digital payment industries in the Middle East region are set for major growth in 2021, with nearly half of consumers likely to increase their online shopping over the next year, according to a report from London-based payment systems provider Checkout.com. Across those countries, 47% of consumers said they expected to shop online more frequently over the next year. Only 15% expected their online shopping frequency to decline, while the remaining 38% expected it to remain the same.

The likely surge in e-commerce and digital payments in 2021 is consistent across the countries surveyed, with 49% of the Gulf Cooperation Council (GCC) consumers saying they will shop online more frequently. Among those who shop online at least once a month, 62% usually pay by card or digital wallet, compared with 44% among the less frequent online shoppers. The survey highlighted a particular preference for mobile commerce and digital wallets in the region, with Apple Pay and Google Pay leading the way, as well as an increased reliance on popular payment methods across the region, such as Mada, QPay, BenefitPay, and Fawry.

“The biggest opportunities lie in getting everyone in the region into the financial system,” said Khalid Dannish, CEO of Bahrain Fintech Bay, adding that the advent of open banking will allow application programming interfaces (APIs) to transform regional payment systems.

The second is online payments via smartphones.

Online payments penetration across MENA had already reached 76%, which is expected to increase. E-commerce is expected to grow exponentially from $8.3bn in 2017 to $28.5bn in 2022. In the GCC, smartphone penetration is at well over 100%.

Advertisement

- Previous article

- Dubai Economy Records 132% Increase in DED Trader Licenses

- Next article

- A 9-year-old Boy Earning 200 Million Per Year Through Toy Evaluation, Why Could This New Generation of Bloggers Take the Lead? (I)

Advertisement

OTHER NEWS

Google Play Store Updates

BY Tammy

Live Shopping in the U.S. is Booming

BY Johnny

How to Get Free Strawberries in Transformice?

BY Kelly

PayPal Q3 transactions hit record total: $247 billion

BY Laura

Fortnite: Top up and Get 2 Months of Disney+ Service for Bonus

BY Julie

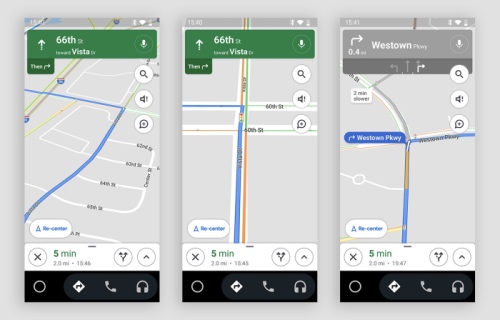

Google Maps to Show the Locations of Traffic Lights

BY Jackson

RECENT NEWS

-

How to Download and Install Wyze App for Free?

-

How to Download and Install VIX for Free?

-

How to Download and Install Minecraft?

-

How to Get Free Units in Marvel Contest of Champions?

-

How to Get Free Strawberries in Transformice?

-

Indian Kids-Focused Fintech Platform Junio Has Raised Seed Capita

1

1 1

1