About Balance Transfer Basics!

Advertisement

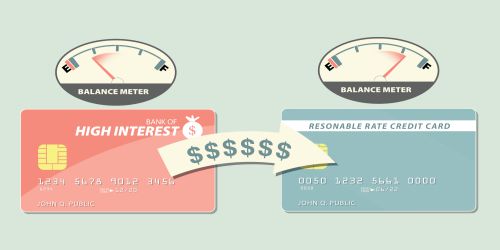

A balance transfer is a financial strategy that allows you to move an existing debt from one credit card to another, typically with the aim of obtaining a lower interest rate or more favorable repayment terms. It can be a useful tool for managing your debt and saving money on interest payments. In this article, we will explore the basics of balance transfers and how they work.

Why Consider a Balance Transfer?

One of the main reasons people opt for a balance transfer is to take advantage of a lower interest rate. By moving your debt to a credit card with a lower APR (annual percentage rate), you can reduce the amount of interest you pay each month, allowing you to pay off the debt more quickly. Additionally, balance transfers often come with promotional periods during which little to no interest is charged, providing a temporary reprieve from interest payments.

How Does a Balance Transfer Work?

To initiate a balance transfer, you need to apply for a new credit card that offers this service. Once approved, you can transfer the outstanding balance from your old card(s) to the new one. This can typically be done online or by contacting the new credit card issuer. You will need to provide the necessary information, such as the account number and the amount you wish to transfer.

Balance Transfer Fees

While balance transfers can save you money on interest payments, they often come with fees. Balance transfer fees are usually a percentage of the amount being transferred, typically around 3% to 5%. For example, if you transfer $5,000 and the fee is 3%, you will be charged $150. It's important to consider these fees when deciding if a balance transfer is worthwhile.

Promotional Periods

Many credit card issuers offer promotional periods with low or no interest rates on balance transfers. These periods can range from a few months to over a year, depending on the credit card. It's crucial to understand the duration of the promotional period and any conditions that may apply, such as making minimum monthly payments or paying off the balance within the promotional period to avoid accruing interest.

Credit Score Considerations

Before applying for a balance transfer credit card, it's essential to consider your credit score. Credit card issuers typically require a good to excellent credit score for approval. While applying for a new credit card may temporarily lower your credit score, responsible use of the balance transfer card can help improve your credit over time.

Using Balance Transfers Wisely

While balance transfers can be a useful tool, it's important to use them wisely. Here are a few tips to consider:

a. Research and compare offers: Take the time to research different credit card options, comparing their fees, interest rates, promotional periods, and other terms and conditions. Choose the card that best suits your needs and financial situation.

b. Create a repayment plan: Before initiating a balance transfer, create a repayment plan to ensure you can pay off the debt within the promotional period. Be realistic about your ability to make the required monthly payments and factor in any fees associated with the transfer.

c. Avoid new debt: While focusing on paying off transferred debt, it's essential to avoid accumulating new debt. Be mindful of your spending habits and work towards financial discipline.

d. Close old accounts (if necessary): Once you've successfully transferred your balance, you may choose to close your old credit card accounts. However, be cautious as closing old accounts can impact your credit utilization ratio and potentially lower your credit score.

Advertisement

Advertisement

- Previous article

- What to do When Your Auto Insurance Claim is Denied?

- Next article

- Maximizing Credit Card Rewards: How to Redeem Them Effectively!

Advertisement

OTHER NEWS

When a Couple Buys a House Together, who is Better to Choose as the Primary Lender for the Loan?

BY Little Grapes

Strategies for Success in the Watch Industry

BY Little Grapes

What Does a Real Estate Agent do?

BY Anna

What to do if Your Home Insurance Claim is Denied: A Comprehensive Guide!

BY Wendy

Crucial Factors for Your Ideal New Construction Home: A Guide to Finding Your Dream Residence!

BY Wendy

How do I get a Claim After Purchasing Home Insurance?

BY Anna

RECENT NEWS

-

Demystifying Bitcoin

-

Securing and Maintaining High Limit Credit Cards: A Comprehensive Guide!

-

The investment value of men’s watches

-

Guarding Against Credit Card Fraud: What to Do If Your Identity Is Compromised?

-

Strategies for Success in the Watch Industry

-

Understanding Survivorship Life Insurance: Planning for the Future Together!

1

1 1

1