Advertisement

A study conducted by Capital On Tap on the global digital payment market indicates that as early as in 2022, cash payment will become the world's least used mode of payment.

The study also found that the increasing popularity of E-wallets, the improvement of service quality, the growing demand for smartphones, and the development of 5G and payment service providers are key factors for the rapid growth of the digital payment industry.

In addition, the global spread of the covid-19 epidemic has also accelerated the development of digital payments. Many consumers are now trying to avoid cash transactions, and instead use contactless payments as much as possible to ensure their own safety.

Advertisement

In terms of payment methods, debit card is the most popular payment method around the world in 2020, and its leading position will be maintained in the following years. However, cash (currently the second most common payment method) will be replaced by digital wallets.

In 2022, cash will be the least commonly used payment method in the global market. It also means that the cashless economy may arrive earlier than previously predicted.

In addition, the study also shows that the current total daily active users of mobile payment apps around the world are close to 1 billion, accounting for 12% of the global population, and the number will exceed 1.3 billion in the next three years. In China, the registered users of two leading payment apps, AliPay and WeChat, have exceeded 1 billion respectively.

According to calculations, currently 47% of smartphone users in China frequently use digital wallet apps, which makes China the country with the highest penetration rate of mobile payment in the world. In contrast, the business model of PayPal, one of the earliest digital wallet companies, is slightly different. Unlike most mobile payment apps, transactions on PayPal are not limited to conduct on mobile devices.

Despite the increasingly fierce competition in the digital payment market, the number of PayPal users continues to grow yearly. The study shows that the number of Paypal users has increased fourfold in the past 10 years, and its total number of users in 2020 will exceed 325 million.

Advertisement

- Previous article

- TikTok Partners with Shopify on Social Commerce

- Next article

- Flipkart and Amazon Will Face Fierce Competition from JioMart

Advertisement

OTHER NEWS

UK Government to ban Installation of Huawei’s 5G Network

BY Watson

Healthy Ways to Help Kids Grow Up

BY Ruby

Why human beings cannot digest corns?

BY Norma

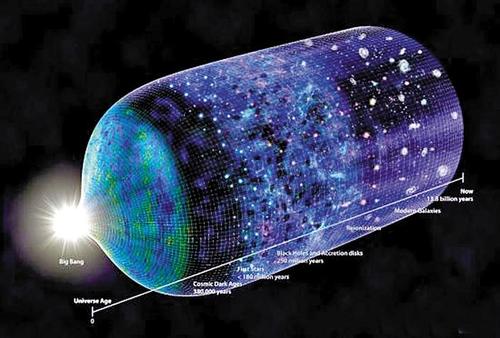

Hearing the Shape of a Drum: From Digital Signal Simulation to the Shape of the Universe

BY Beverly

Amazon Is in Negotiation to Buy Wondery, Quoting $300 Million to Gain a Foothold in Podcasting

BY Phyllis

KIM Kardashian Spent $7 Million on Her Birthday

BY Earl

RECENT NEWS

-

PUBG Mobile Esports Generated 200 Million Hours of Viewing in 2020

-

Mario Kart Tour Races to $200M revenue and 200M Downloads

-

Game Acquisitions Expand Globally in Q1 2021 with 280 Deals Worth $39 Billion Surpassing That in 2020

-

Free Fire Shows Strong Momentum, with Its Revenue Overtaking PUBG Mobile in a Single Market for Q1 2021

-

The Games Fund Launched a $50 Million Early Investment Fund to Invest in American and European Companies

-

How to Download and Install Wyze App for Free?

1

1 1

1